Having sainsburys credit card gives you the freedom to use credit instead of cash right away for purchases. This can be especially helpful in situations where there are large, unexpected, or pressing costs. From a financial convenience standpoint, a credit card can be thought of as an unsecured, short-term loan. It’s important to remember that your assets are not as directly at risk from credit card debt as they are from other types of loans.

But being successful with your credit card application—particularly if you are looking for a card with the best terms—often depends on having a high credit score. The approval process heavily relies on this numerical representation of your creditworthiness.

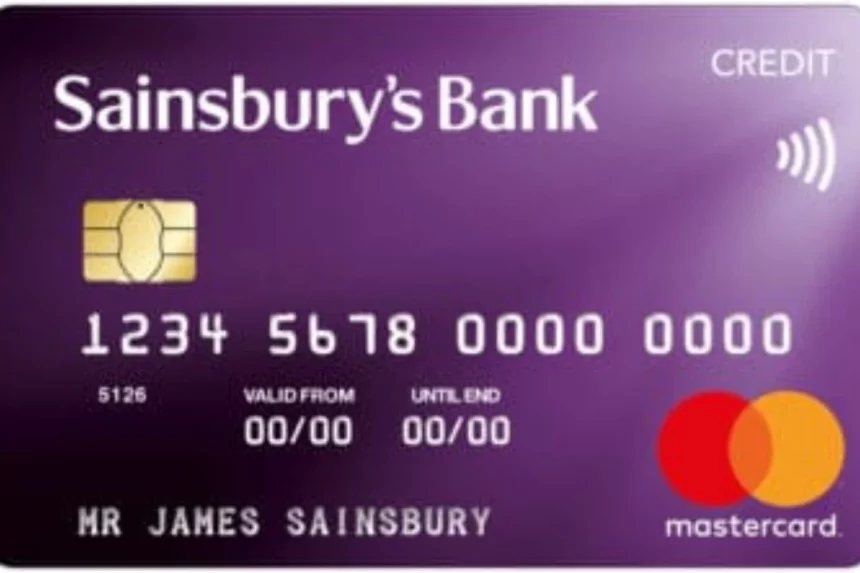

Brief About Sainsburys Credit Card

You may locate interest-free credit cards that provide 0% interest on purchases for a longer time by shopping around, often for a year or more. Credit cards with balance transfers could also offer 0% rates to transfer your debt from one card to another. You may be eligible for cashback and points when using certain credit cards. You can employ a few others to raise your credit score despite the signature strip on credit cards or in-person purchases authorisation by a personal identification number or PIN. Read the following article curated by Hoststheory to learn more about Sainsbury’s credit card. Also, you can visit the official website of Hoststheory to grab some exclusive deals on the Sainsbury credit card login and Sainsbury bank credit card.

How to use a Sainsburys credit card?

According to Sainsburys credit card, any transaction, whether for goods or services, may be made with a credit card, whether in person, over the phone, or online. Most companies, except the tiniest, are set up to accept Sainsburys credit card as payment, albeit not all credit card types are accepted universally. When you shop, look for the logos to discover where you may use your particular credit card type to pay.

In order to complete your payment in person, place your credit card through the card reader. As an alternative, the salesman may complete the purchase in front of you. It is imperative that you keep your card visible in order to prevent possible fraud. When paying at a restaurant, present your card; the reader will ask you to confirm the amount. After verification, input your PIN. (In restaurants, there may be a further procedure when you can leave a tip.) As you go, cover the screen to protect your credit card.

Whenever you make a purchase online or over the phone, you will need the following information:

Step By Step Guide to Utilize Sainsburys credit card

- The long credit card number on the front

- The cardholder’s name is as it appears on the card.

- The card’s expiration date

- The card security code (CSC), also known as the card verification code (CVC) or card verification value (CVV), is the final three digits on the signature strip on the back of the card.

When using your Sainsburys credit card to purchase on the internet, many businesses will encourage you to utilize the appropriate system. All you have to do to do this is register your preferred authentication code with the security system. Then, using the same card and online security system, you may use this code to confirm any subsequent online purchases.

Additionally, using the specific online security mechanism provided by your card provider will shield you from responsibility if your card is illegal. Your card may be “pre-authorized” for the entire booking price when you make a reservation, such as for a hotel room or a spot on a course. Pre-authorization is a process that verifies a credit card’s validity and ensures it hasn’t been reported lost or stolen. The pre-authorization amount will appear in your available balance even though it will be deducted from your account once you make the payment.

Pre-authorization is advantageous since it lets the other party know in advance that you have the money to make the payment. However, you still can refuse final payment if you arrive and discover that your room isn’t up to par, for instance.

Also read : Everything You Should Know About Halifax Credit Card

Sainsburys credit card Chargeback Programme

If the “chargeback” scheme is offered by your card issuer, you can get even more protection. You can choose to undo a transaction and get your card refunded under specific conditions. This can be especially helpful if the vendor or retailer from whom you bought the goods is closed for business, or if the goods or services you received are subpar, do not live up to what you were expecting, or are damaged. The majority of bank and credit card firms offer a chargeback service, even though it’s not required by law. When a retailer or dealer disputes the presence of an issue, this becomes significant. In contrast to Section 75 laws, transactions using a credit or debit card that total less than £100 are eligible for a chargeback.

Conclusion

When considering a credit card it’s important to compare the benefits and fees offered by different cards and choose one that best fits your financial needs and spending habits. Sainsburys credit card is the most convenient credit card you must be aware of. Moreover, you can also visit the official website of Hoststheory to learn more about Sainsburys credit card log in and Sainsburys credit card contact.